From: zerohedge

Authored by Michael Lebowitz via RealInvestmentAdvice.com,

Numerous reader requests following our article, Agency REITs For A Bull Steepener, prompted us to write this follow-up with more detail about how to analyze agency REITs. This article doesn’t recommend specific agency REITs, but it does lay out some of the fundamental basics of the largest publicly traded agency REITs. In doing so, this analysis and the prior article provide a solid foundation for further evaluating agency REITs.

Before diving in, it’s worth noting that most agency REITs offer preferred shares. While we do not discuss them in this article, preferred shares may also prove rewarding and less risky in the current bull-steepening interest rate environment.

(Disclosure: RIA Advisors has a position in NLY and REM in its client portfolios.)

Managing A REIT

An agency REIT is only as good as its portfolio management team. As we wrote in Agency REITs For A Bull Steepener, the portfolio management team has to buy rewarding assets and issue appropriate liabilities to fund the investments, but it must also constantly hedge the portfolio for interest rate and mortgage spread risk. Furthermore, they actively trade derivatives to transform the terms and conditions of their liabilities.

Due to the leverage employed by the agency REITs, a firm making poor hedging decisions could be forced to sell assets or issue liabilities at inopportune times. Poor management can result in reduced or missed dividend payments.

Conversely, the costs of over-hedging can eat dearly into the REITs profits, resulting in minimal dividends. Finding the right balance between assets, liabilities, and hedges is a tall task. The portfolio manager’s skills in managing the portfolio can make a big difference in returns when comparing REITs.

We cannot quantify portfolio management skill levels, but we share information on each REIT to help you better understand some differences between the largest agency REITs.

Evaluating Agency REITs

Due to the unique agency REIT business model, evaluation requires tools different from those commonly used for stocks. Agency REIT investors prefer metrics like price to book value, leverage, interest rate spreads, dividend reliability, and value at risk. Earnings, sales, and traditional margin and valuation calculations are not as helpful.

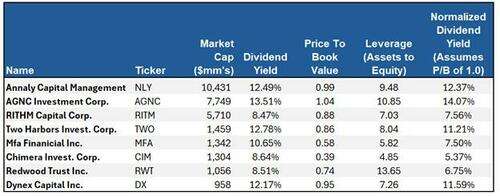

The following table shares information on the top publicly traded agency REITs. Further sections below focus on three factors that help determine risk and investor returns. The tables in those sections show the latest respective data, the ten-year ranges, and the size of the ranges to provide better context for the current figures.

Price To Book Value

The price to book value tells investors how much portfolio value or equity (assets minus liabilities) they own per share. The ratio varies due to the whims of investors. Investors should prefer a price-to-book value ratio below 1.0 as they essentially buy the portfolio for less than 100% of its value. However, a price-to-book value ratio well below 1.0 may indicate trouble.

Due to the volatile nature of agency REIT assets, liabilities, and hedges, the book value is in constant motion. Unfortunately, most agency REITs only report the book value quarterly. Accordingly, caution is warranted because the book value is always stale, while price changes are current. In other words, there are only four days a year when the price-to-book value ratio is correct. There are ways to estimate book value to help overcome this problem.

Agency REITs are incentivized to grow as a larger portfolio creates more income for the company executives and the portfolio management team. Growing entails issuing more equity.

Agency REITs often offer new shares to the market when the price-to-book value is above 1.0. Doing so allows them to raise more money per share than the net portfolio value. New issuance often causes the stock price to decline toward a price-to-book ratio of 1.0. When the price-to-book ratio is below 1.0, issuing shares is not as economically beneficial to the REIT; however, it adds value to existing shareholders.

The table below shows the latest price-to-book value of the eight largest publicly traded agency REITs. In most cases, these are about three months old. Since bond yields fell over the last few months and the spread of mortgages to liabilities tightened, the portfolio values are likely higher than last reported. That said, many share prices of the stocks also increased in value.

Leverage

To better appreciate the importance of leverage, we share the following simplified summary of the creation of an agency REIT. It is from Agency REITs For A Bull Steepener.

Hypothetically, let’s start a new agency REIT to help you appreciate how they operate.

We solicit $1 billion from equity investors.

A significant portion of the $1 billion is used to buy mortgage-backed securities (MBS).

We then borrow $4 billion from a bank using the $1 billion of MBS as collateral.

The proceeds from the $4 billion loan are also used to purchase MBS.

Our new REIT has about $5 billion of MBS against $1 billion of equity and $4 billion of debt.

As a result, the REIT has 5x leverage.

The amount of leverage is an essential gauge of risk. If, in the example above, the REIT borrowed $50 billion with only $1 billion of equity, resulting in 50x leverage. A 2% adverse move in the portfolio would wipe out the entire equity value. Conversely, 5x leverage takes a 20% loss before equity holders are wiped out.

Not only is the amount of leverage essential to track, but how and when the leverage changes can help us gauge the portfolio manager’s stance toward present risks. Also of equal importance to those gauging risk is the hedging activity. Specifically, how is the portfolio management team using derivatives to transform liabilities and manage risk?

Solid hedging skills can partially offset the risks of high leverage. Conversely, a REIT may have low leverage but still poses high risk due to poor hedges.

Dividend Reliability

Given the outsized dividend yields on agency REITs, the reliability of the REIT’s dividend is important. Like other key metrics, we should compare the current dividend to its historical range to appreciate how it can potentially change in favorable or adverse environments.

An Agency REIT Alternative

If you are uncomfortable picking specific agency REITs, we recommend diversifying among many to reduce idiosyncratic portfolio risks.

One way is via the iShares Mortgage Real ETF (REM). The ETF’s two largest holdings, accounting for over 25%, are NLY and AGNC. Bear in mind some of its holdings are not agency REITs. Accordingly, they may contain assets that the government does not guarantee.

Summary

Without a background in managing a portfolio of mortgages, analyzing agency REITs can be challenging. However, putting in more homework than is typical for a stock investment can provide investors with returns often uncorrelated with the broader market, thus offering a unique form of diversification. If you decide to research agency REITs, we highly recommend you read their quarterly and annual reports, which are incredibly detailed and insightful.

Agency REITs are not for buy-and-hold investors. They tend to perform well in specific economic and interest rate environments and poorly in others. We believe the current bullish steepening shift in the yield curve could offer investors opportunities with the agency REIT sector. However, we stress REIT portfolios can gain value while its shares lose value.