From: zerohedge

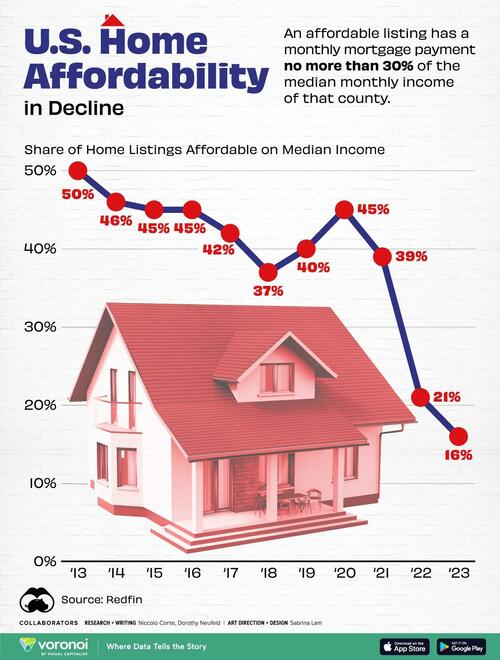

A large share of affordable homes vanished over the pandemic, leading the supply to hit its lowest level on record in 2023.

Many buyers have become priced out of the market due to soaring home prices and high interest rates. Last year alone, the number of affordable homes shrank by almost 41%, equal to over 243,000 properties.

This graphic, via Visual Capitalist’s Dorothy Neufeld, shows the dwindling supply of affordable U.S. homes, based on data from Redfin.

The Sharp Decline in Housing Affordability

In 2023, only 16% of homes were affordable in America, falling from 21% in the year before.

An affordable listing was defined as one with a monthly mortgage payment no more than 30% of the median monthly income of that county. Below, we show the share of affordable listings in the 97 biggest U.S. metropolitan areas by population:

As the above table shows, housing affordability has grown increasingly out of reach as mortgage rates have more than doubled in just two years.

While affordable homes made up 39% of the market in 2021, the share dropped precipitously as interest rates climbed higher. In 2023, the average annual 30-year fixed mortgage rates reached 6.81%–hitting its highest level in 20 years.

Although mortgage rates may decline over the year if the Federal Reserve cuts interest rates, it may not be enough to boost the supply of affordable housing.

That’s because rates may not fall sharply enough to undo the “golden hand-cuff” effect, where homeowners are reluctant to sell in order to hold on to their low mortgage rates. Adding to this, home construction has fallen significantly since the global financial crisis. During this time, home builders and lenders became increasingly cautious, leading home construction to drop 55% between 2006 and 2021.

What Comes Next?

The good news is that new-home construction is forecast to increase in 2024, with single-family housing starts projected to grow 4.7%.

While new home sales have historically comprised 10-12% of the single-family home market, they have recently surged to 30% due to the collapsing supply of existing homes. But even as new supply enters the market, it will likely take a number of years for housing affordability return to historical levels.

In fact, JP Morgan suggests that it could take two years if mortgage rates drop by 1 percentage point, assuming that home prices remained at all-time highs and wages continued rising at their current pace.